A brief overview

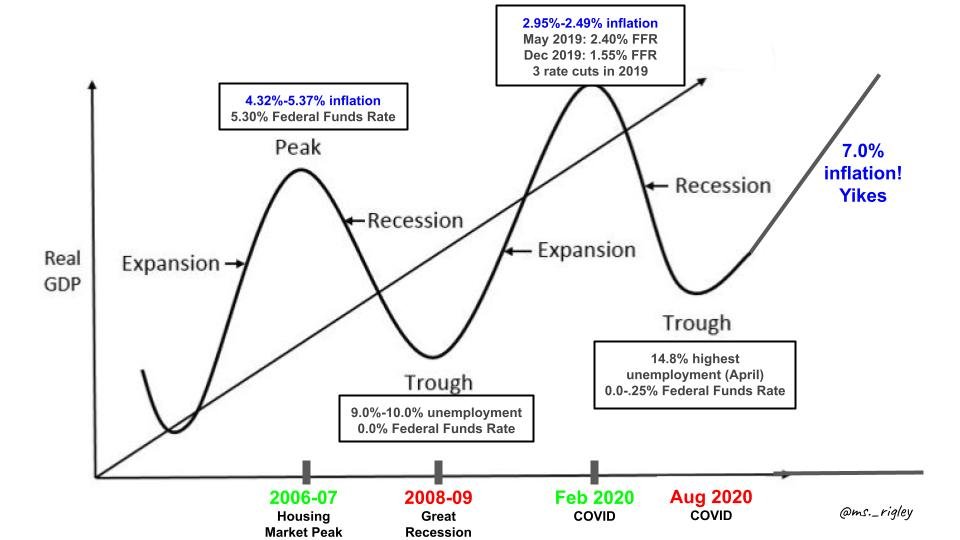

The Federal Reserve is the central bank of the United States. They have two main jobs: 1. fight inflation and 2. fight unemployment that is caused by a recession. With inflation at 7%, the highest it has been in 40 years, we currently have an inflation problem.

So what can the Federal Reserve do about inflation?

Raise interest rates

Some background

The Federal Reserve controls two interest rates (discount & federal funds rate) that set the floor for all other interest rates in the U.S. During the COVID recession, the Federal Reserve dropped their interest rates to zero. This gave us historically low interest rates on home loans and tanked the interest rates on new bonds and my high yield savings accounts. In addition, the Federal Government injected over $6 trillion into the economy.

Now we have 7.5% inflation as of January 2022.

In December 2021 the Federal Reserve announced that they would raise interest rates starting in March 2022 and would probably implement 3 rate hikes over the course of 2022. After their meeting on January 26, 2022, the Fed confirmed this trajectory.

Cool.

So why should you care?

3 Reasons:

#1: If you are looking to borrow money or refinance, interest rates on new loans will continue to rise. These rates are already well off their COVID lows in anticipation of the Fed’s interest rate hikes. Historically speaking, these interest rates are still low and great.

#2: If you have an adjustable rate loan, you should plan for a payment increase.

#3: The interest rate on my high yield savings account (HYSA) will finally get out of the gutter which is 0.50% (still a solid 50x what Wells Fargo pays at 0.01%). In addition, the returns on new bonds will also rise. Personally I am only interested in I Bonds as they are tied to inflation and paying 7.12%. Most other bonds currently pay around 1% which doesn’t offer much more than my HYSA, especially after the Fed raises interest rates.

The takeaway: it is about to get more expensive to borrow (inevitable) and we are about to see higher returns in savings vehicles like Bonds and HYSAs (yipee!).

Reminder: 7% inflation is significant. Non I Bonds and HYSAs are not going to keep pace with 7% but they will do better than your savings in Wells Fargo, Chase & Bank of America. To achieve financial freedom, you have to have emergency savings so we can’t forgo our savings because inflation is high and destroying our purchasing power. We just need to make the best financial moves possible to protect as much purchasing power as possible.

As you can see the peak Federal Funds Rate before the housing crash in 2006-07 was 5.30% and inflation hit a peak at 5.37%. We have already surpassed this inflation number and are sitting at a Federal Funds Rate of 0.25%. The Federal Reserve probably has some significant interest rate hikes ahead of them.

However, they will go slowly to see how the economy responds. They don’t want to raise rates too quickly and trigger a recession, at the same time they need to get inflation under control. The normal average inflation for the U.S. is 2%.