Millions of young people head off to college in the U.S. each and every year. Yet, no one takes time to explain the costs and student loans. As another year of college is about to begin, let ´s take a few moments to get some clarity on student loans.

First, there are 3 types of Federal student loans:

Subsidized (no interest accrued while in school)

Unsubsized (interest day 1)

Direct or Parent Plus (interest day 1)

Young people who are dependent on their parents, meaning you get claimed on your parentś taxes because they financially support you, can only take out $5,500 of student loans in your name per year. The loans that are offered to dependent young people are Subsidized and Unsubsidized Federal Student Loans. 90%+ of all colleges costs more than $5,500 per year in tuition and housing. To cover the remainder of the costs you either need scholarships, work and/or a guardian to take the rest in a Direct/Parent Plus loan.

Subsidized loans look like the best option because they do not accrue interest until you graduate but the Federal government will only give you some of the $5,500 in Subsidized loans. Boo!

All 3 of these loans, and other school financial aid like work study and grants, are received by filling out FAFSA – free application for federal student aid which opens October 1st every year. You must reapply for FAFSA each year you are in school to receive aid for the following school year.

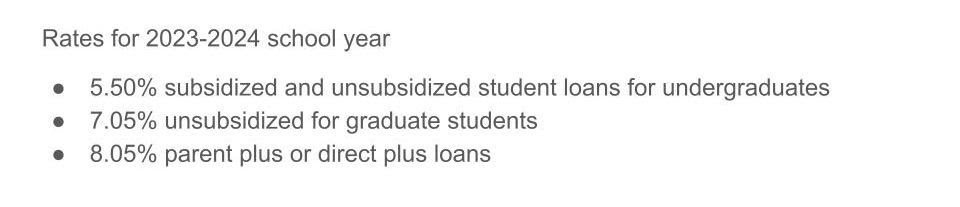

The interest rate for these loans are set every year in June and are fixed for the duration of the loan, meaning the interest rate will not change unless you refinance.

Here are the interest rates for the 2023-24 school year:

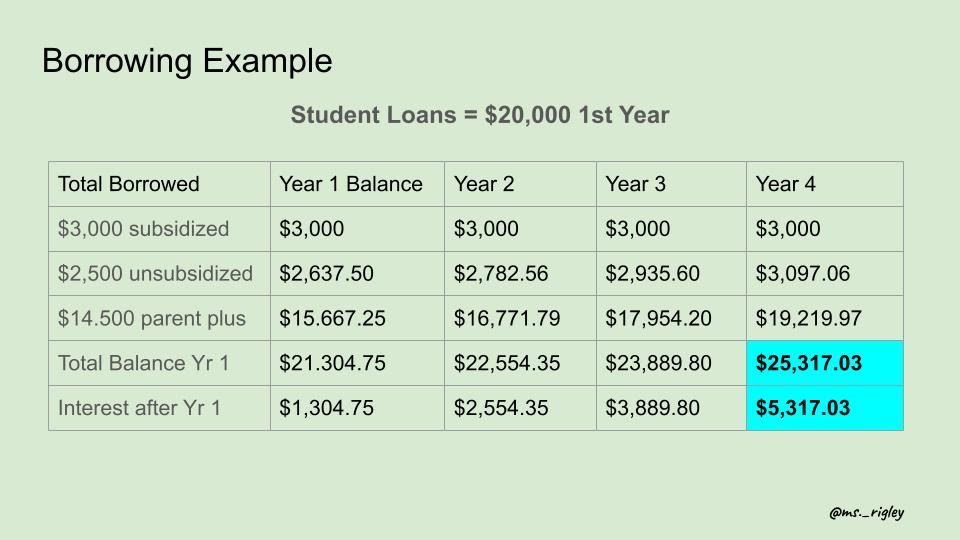

Let´s see how this plays out for a student borrowing $20,000 for their first year of school:

By the end of all 4 years in college, the first year of borrowed money grew from $20,000 to $25,317.03. The interest for student loans compounds. This means that every year, the interest that accumulated over the previous year, is now also being charged interest.

For example, in Year 1, you borrowed $2,500 in unsubsidized student loans. At the end of year, with 5.50% in interest, this balance is now $2,637.50. For year 2, you are not paying interest on the original amount borrowed of $2,500, you are now paying 5.50% interest on $2,637.50! Yikes! Over 4 years, compound interest costs you an extra $47.06 on this one loan.

Now that we understand the interest on these loans, lets take a minute to look at what repayment could look like.

This is only the repayment for the first year of $20,000 borrowed. The interest rate on the loans is released every June for the following school year. I cannot calculate the remaining school years without the interest rate.

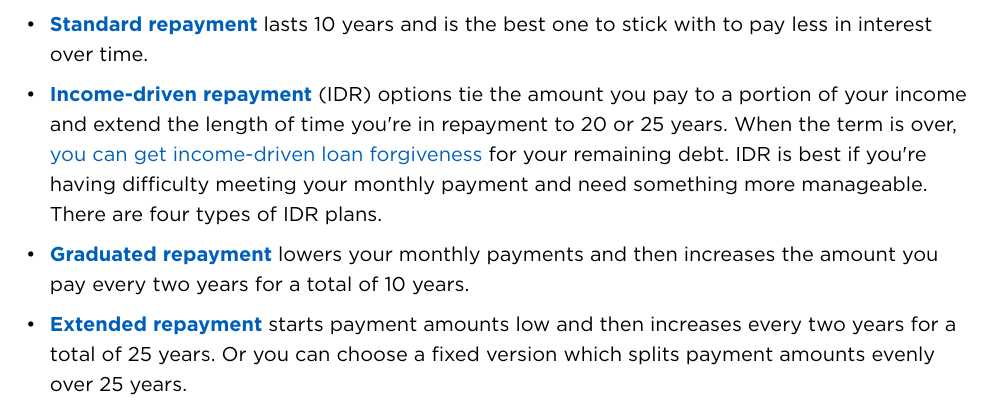

FYI, there are 4 student loan repayment plan options. Below is a nice summary from Nerdwallet.

FYI, if choosing one of the Income-Driven repayment plans, your balance may grow even though you are making your monthly payments. This happens because your 10-20% payment is not enough to cover the interest due for that period and is not paying off any of the original amount borrowed. After 20 years of payments for undergraduate loans and 25 years for graduate loans, your loans will be forgiven but you may owe income taxes on the amount forgiven.

The interest rate changes based on what is happening with the economy and the Federal Reserve. The Federal Reserve has announced that they could raise interest rates 2 more times during 2023. If that is the case and the economy remains strong (meaning we are not in a recession) then next year you can expect the student loan interest rates to be a bit higher than this year. Remember that the interest for your student loans for 2023-24 are fixed and will remain either 5.50%, 7.05% or 8.05% depending on the type of loan.

All of this information doesn´t mean don´t go to college and take out student loans. I just want you to be an informed consumer.

Disclaimer: I am an educator, not your personal financial advisor. Information in this newsletter is intended for educational purposes only. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!