Last year buying IBonds was a no brainer as interest rates were paying 7.12% followed by 9.62%. In June 2022, inflation peaked at 9.1% and IBonds were the only investment option that could even remotely keep up with inflation while also keeping your principal safe. Ergo, a no brainer.

Remember that the interest rates are stated as a yearly rate but you only receive this rate for 6 months, meaning 9.62% equates to 4.81% for 6 months then the interest is paid out. Then you receive the new interest rate for the following 6 months.

Since June 2022, inflation has been on the decline but still much higher than the normal 2%. As of November 2022, inflation is 7.1%. December´s inflation numbers are released on January 12, 2023. Meanwhile the Federal Reserve hiked interest rates 7 times bringing the Federal Funds Rate to 4.25% to 4.50% from zero.

What does all this mean for IBonds?

The IBond interest rate is based on the change of inflation from March to October or November to April and right now this number is falling (good news for our budgets but a lower interest rate for our ibond accounts). From November 2022-April 30, 2023 IBonds are paying 6.89% (3.445% paid at 6 months) and I expect that rate to be much lower for May 2023. This article estimates 2.2% for the annual rate (1.1% for 6 months) in May 2023 meaning the combined yearly rate would be 4.54%.

If you buy more IBonds in January, you will enjoy the 6.89% for 6 months. Remember that you get the interest rate at the time of purchase for 6 months. If you buy on April 29, you will get 6.89% until October 29th.

The inflation numbers for March come out on April 12th which will give us a better idea of the new interest rate.

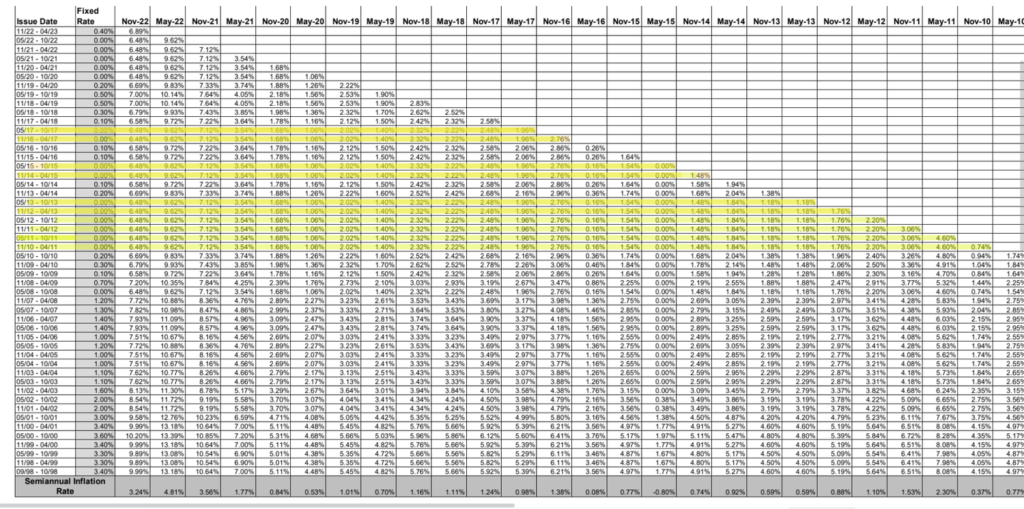

The one unknown is the fixed rate. The current IBond interest rate includes 0.40% fixed rate. That means, as long as you have the bond, you will always receive a base of 0.40%. The previous interest rates had a fixed interest rate of 0%. It is possible that the IBond interest rate for May 2023 will include an even higher fixed rate which will pay out as long as you have the bond. The new interest rate, including the fixed rate will not be announced until May 1, 2023.

If you do not purchase before May 1st, you could lose out on 6.89%. However, if you wait, you might (no guarantee) gain a higher base rate which could equate to more money over the life of the bond. It is a gamble.

Other considerations

At the end of 2021, the Federal Reserve was really clear that they were going to raise interest rates 7 times in 2022 and they kept their promise. They have been less clear about their actions for 2023. The Federal Reserve is determined to get inflation back to 2% and will continue to hike interest rates to get there. However they have not made any announcements about the number of interest rate hikes that might require.

Each time the Federal Reserve raises interest rates, the interest rate on high yield savings account climbs and so do the interest rates on CDs (certificates of deposits). Right now Ally Bank is paying 3.30% in their savings accounts (no penalty for taking money out) and are offering 18 month CDs for 4.25%. It is possible that interest rates will remain high for a bit.

So …

I don´t know.

When inflation is not a problem (like most of the 2000s, 2008 saw peak inflation of 5.6%) IBond interest rates are nothing extraordinary. Sometimes IBond rates outperform high yield savings accounts and sometimes they underperform. What really makes IBond rates pop during low inflation years is the fixed rate which is currently 0.40% but could be much higher in May. During a recession, IBond rates are 0% but Ally´s high yield savings account never went below 0,50%.

Since we are currently in a period of high interest rates (implemented by the Federal Reserve), it is possible that IBonds will underperform high yield savings accounts and CDs from May onwards but may have an attractive fixed rate.

So we are going to buy half of our IBonds now and half in May if the rate makes sense. In May I will know the new fixed rate and how interest rate hikes are playing out in CDs and my high yield savings account. My husband and I are hedging our long term savings. If you are close to retirement and not looking for super long term savings then CDs might be the way to go.

Remember that you cannot take out IBond money during the 1st year. If you withdraw before 5 years, you lose 3 months of interest. After 5 years you take out your money without penalty and you will owe taxes federal income taxes. IBonds are exempt from state and local taxes.

If anyone else has thoughts on the subject, I would love to hear your thoughts.

Here is the link to the historical IBond rates shown below if you want to examine more closely. Read my blog post if you want specifics on IBonds.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this blog post.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!