How does the topic of investing make you feel? Like the picture above or more like this …

For many people investing is a foreign and terrifying topic. Most of us are never taught how to invest and therefore build wealth. Over the years I have made terrible mistakes and learned a lot along the way. Mostly what I have learned is that investing, especially for young people is incredibly easy. Let me show you.

Disclaimer: If this is your first introduction to investing some of these terms may be confusing. I tried my best to simplify. In my online class I explain everything in great detail if you want to learn more or check out my Instagram videos for more investing specifics.

Step #1: Open an investment account

I love Fidelity because you can open a Roth IRA or any other account you fancy and you can buy partial shares which has been a powerful and incredible change for individual investors like you and me. I encourage young people to open a Roth IRA (retirement account) because their investments will grow tax free.

Step #2: Put money in your account

Step #3: Make your purchase

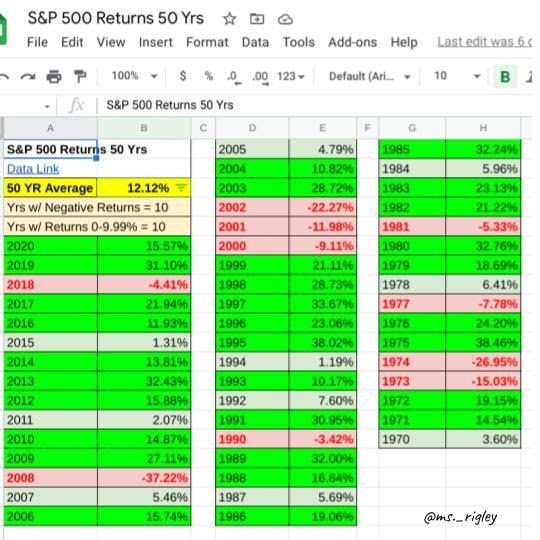

This is where the mistakes happen. Most people think they have to pick the winning stock and there are A LOT of emotions tied to trading individual stocks. On a daily basis stocks go up and down and it is almost impossible to predict the daily moves. I don’t want my students to buy individual stocks. I want my students to buy 500 stocks, also known as the S&P 500. This is an index that tracks the largest publicly traded stocks in the United States. This index includes Tesla, Disney, Facebook (Meta), Nike, Google (Alphabet), etc. Buying this index can be done through ETFs like SPY, VOO or IVV. Over the long term this index has return 10% per year.

Step #4: Try to add to your investments each month

For young people, I encourage between $500-$750 per month. How much they can invest all depends on their life situation and budget! Investing something per month is way better than nothing.

Step #5: Let your money work & leave your investment alone

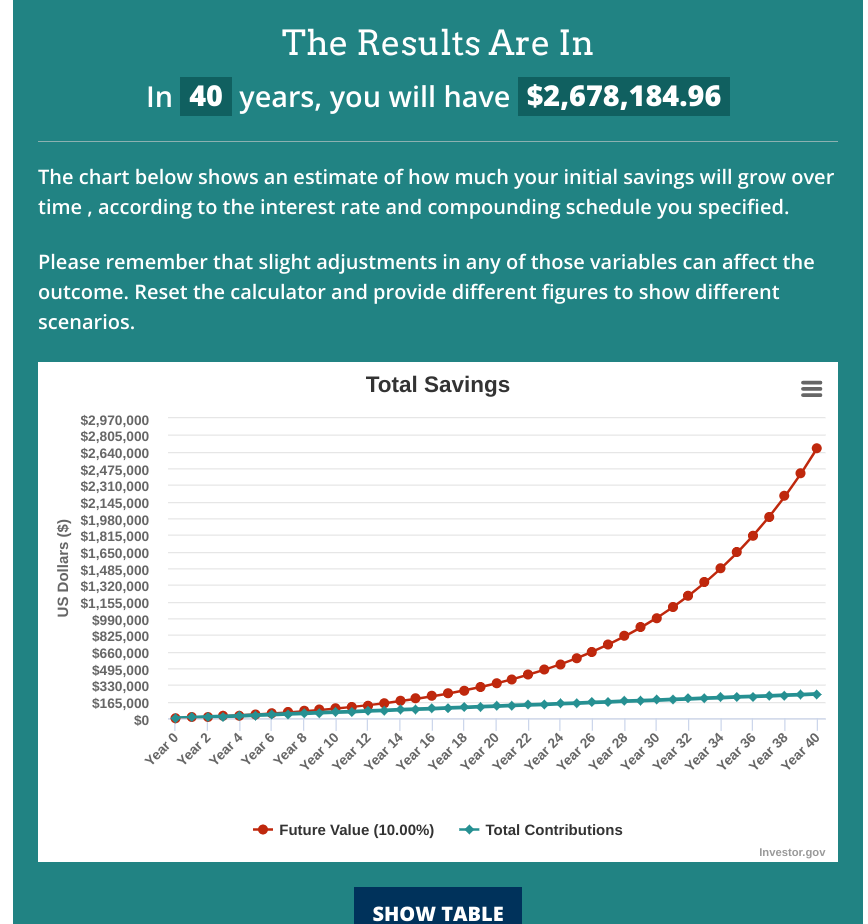

These are the results of investing $500 a month at a 10% rate of return (historically what the S&P 500 has done) for 40 years (from age 20-60 years old).

Wow! Investing is life changing information and why I am so adamant about teaching high school seniors investing and personal finance. Investing and all of personal finance curriculum has the power to transform peoples’ financial trajectory and therefore their lives.

If you are crying because you aren’t 20 yrs old, I am with you. Investing is still a powerful tool to keep up with inflation and build wealth (i.e. make your money work for you). Since we don’t have the same amount of time, we either have to invest more per month (doing whatever we can) or if you are near retirement, it might be helpful to talk to a financial planner.

If you want to learn more, please join my investing class. I offer live coaching for all students to guarantee that you have the skills and confidence to transform your finances and make your money work for you. To see all of my classes, please click here. For more details, please visit my website.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!