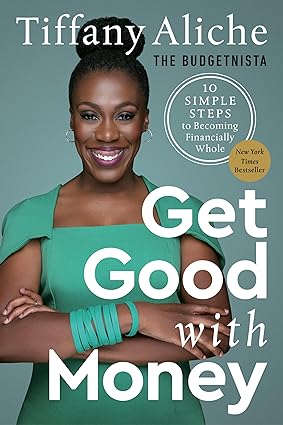

Today we are going to talk about valuable recession advice given by The Budgetnista Tiffany Aliche in her book, Get Good with Money. This advice can be great for a loss of income, low wages and/or rising prices.

Step #1: Tiffany says to prioritize payments on all expenses that provide for your health and safety. This can be medication, health insurance, housing, utilities. If you lose your job and have insufficient savings, make these payments first.

Step #2: Use a ramen noodle budget. This means if you chop as much as possible out of your budget which includes your food bill. What is the cheapest food you could eat and still be sustained? Ramen noodles? Beans & rice? Etc. This is what you eat. You are not meant to live on a noodle budget forever but riding out a recession could take 6 months+.

Remember that if your purchase does not provide for your health and safety it needs to go (Cable, I am looking at you).

Economic and financial stressors are real and we all cope with stress in various ways: some healthy (going for a run, doing art, journaling, etc) and some unhealthy (eating our feelings, retail therapy, drinking, etc). If you find yourself with unexpected financial stress, try to identify why you are stressed and what healthy actions could give you some relief. Sadly many of our unhealthy coping mechanisms will only make the financial stress worse.

Step #3: Work to increase your income either through finding a job, working a side hustle or negotiating a raise. A noodle budget is not sustainable forever so you have to get your income up as expenses can only be cut so far.

Step #4: The ultimate goal is to have an emergency fund that covers 3-6 months of living expenses (maybe more depending on your job security). If you are economically stable but have yet to fully fund your emergency account, you need to cut some expenses or increase your income to turn up the volume on your emergency savings. You have to prep for a recession when the economy is good. If you wait until we are officially in a recession, you are in trouble.

Tiffany´s book is great so make sure you check out the rest.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this blog post.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!