Figuring out your financial freedom number requires a few things:

1. To know your monthly expenses, which we can multiple to get your yearly expenses. This can be figured out by looking at your budget or working with me to build you a budget.

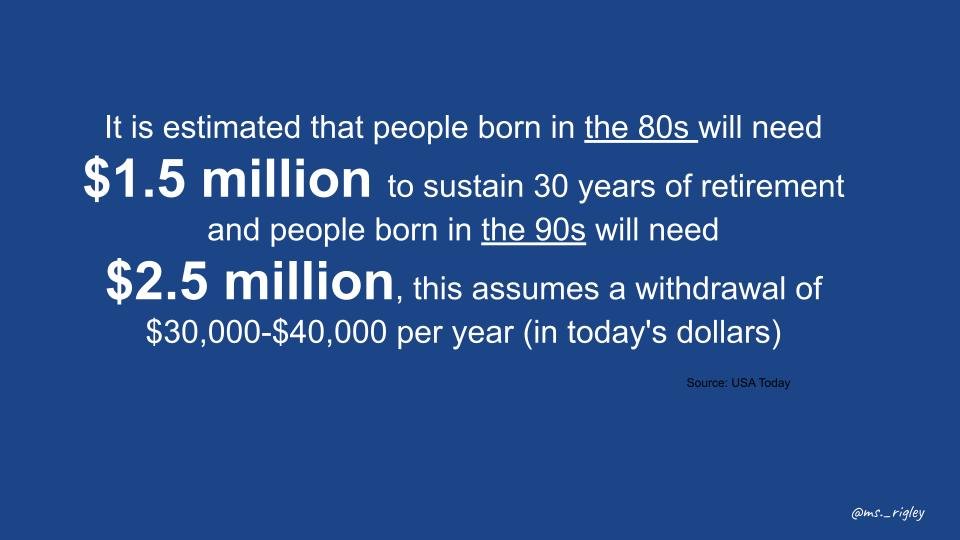

2. You need to make an assessment of your financial needs in retirement. For example, do you own a home? Will your home be paid off before retirement or do you plan on doing a reverse mortgage. Housing tends to be a large part of peoples’ expenses (especially in California). If your housing cost will not be an issue in retirement then your annual expenses will be lower which will lower your financial freedom number. Also consider your needs later in retirement which include medical and possible assisted living. If you are young, this is almost impossible to predict and I encourage you to invest and save as much as possible.

3. Do you have social security or a pension? If yes, then that should be included in this calculation. Let’s do an example. Say your monthly expenses are $5,000 and you expect to get a social security payment of $1,500 a month. This means you need an additional $3,500 per month to cover your existing lifestyle in retirement. $3,500 x 12 gives you an annual expense of $42,000. $42,000 x 25 = $1,050,000 is your financial freedom number.

This equation comes from the Trinity Study which developed the 4% rule. This rule states that a 4% withdrawal rate is how much you can withdraw from your retirement account each year and not run out of money. This is not a guarantee but the safest number that resulted from this study.

A word of caution: if you retire during a recession and your first retirement withdrawal comes when the Stock Market (and maybe your account value) is down 25% or more, you have a greater chance of running out of money vs someone who took their first withdrawal when the Stock Market and their account was up for the year.

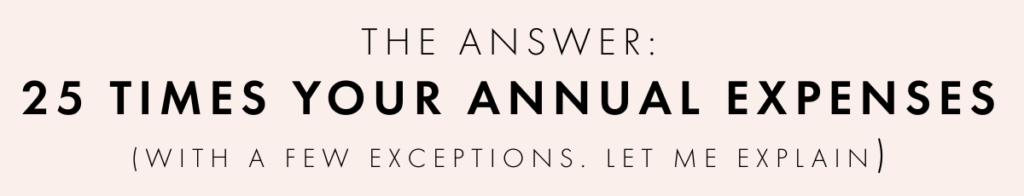

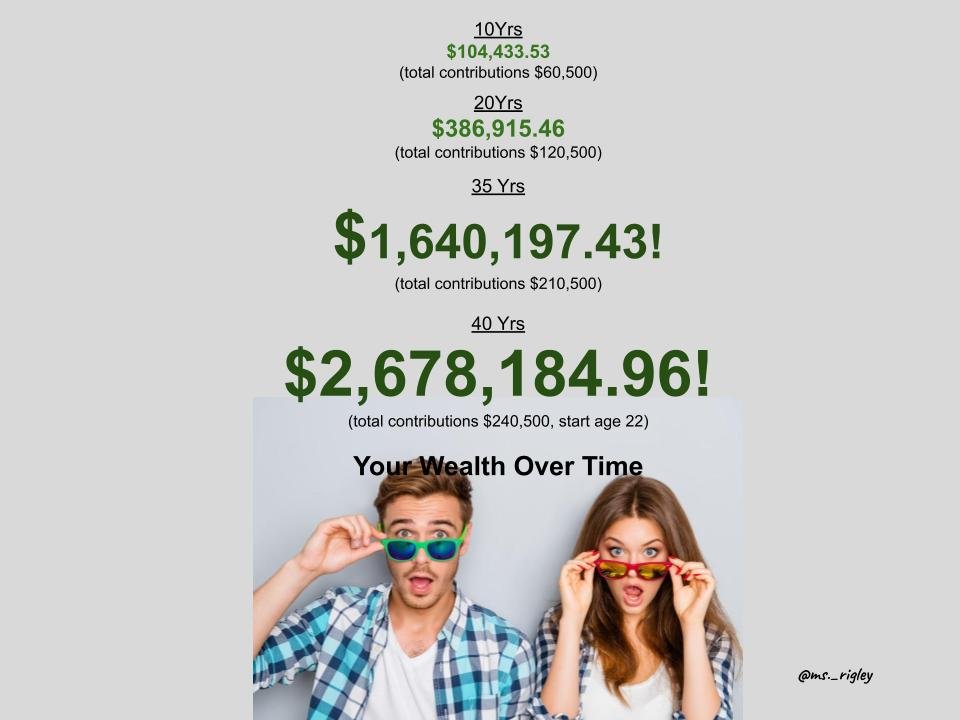

So want to know how much money you need to live life on your own terms? Take your yearly expenses and multiple by 25. Then you can use an online calculator to figure out how much money you need per month to make this your reality. Check out my blog post for specifics and directions on calculating your monthly investing number. If you don’t like this number or timeline, see what you can do to cut your expenses (maybe even move somewhere cheaper) and/or increase your income.

This financial freedom number can be reached at any age and there is a movement called F.I.R.E (financial independence retire early) where young people are doing just that. Usually this takes dramatically cutting expenses and increasing their income so they can hit this number well before 60 years old.

If you are unsure about investing or don´t know how to get started, join my class!

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this blog post.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!