If you are not familiar with a ROTH IRA, please read this past blog post to get caught up.

Why you should consider opening a custodial ROTH IRA:

#1: Help your child start building financial freedom NOW!

Financial freedom is having enough money to do whatever you want in life. This means traveling, spending time with loved ones, being able to say goodbye to a job that is not serving you, getting the healthcare you need, etc. Achieving financial freedom takes time for compound interest to work it´s magic. The sooner you can get started, the sooner you can make financial freedom your reality. For Gen Z, financial freedom is estimated to cost at least $3,000,000.

#2: Roth IRA money grows tax free

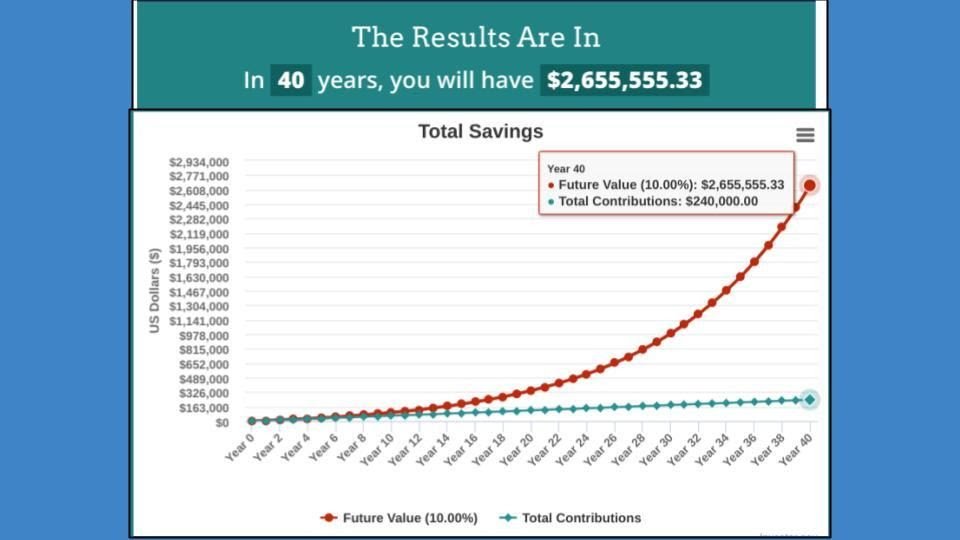

There are a few investment accounts that can be opened by young people without much parent involvement, however, these accounts don´t grow tax free. If a young person invests $500/month (the goal once working a salaried job) for 40 years, their $240,000 investment will be worth $2,655,55.33, ALL TAX FREE. All other investment accounts will require you to pay taxes.

The graph below is for $500 invested per month @ 10% rate of return which is the historical average of the S&P500

Cons of this account

#1: The adult is the owner, not the child since they are under 18.

This means you have to use your information to open the account which will be housed under your login and password. In order for your child to invest their money, you will have to login, make the transfer and the investment, or let them do it once you login. This is not the best scenario but the only option.

#2: Your child should have earned income (i.e a job).

The max contribution to a Roth IRA is $7,000 per year (for 2024) or their max earnings for the year. For example, if your child makes $100 a month ($1,200 per year) babysitting, then the most they could put in their Roth IRA per year is $1,200. Their earned income can come from an official job or odd jobs like babysitting and mowing the lawn. I am not sure how closely this is monitored by the IRS since you do not owe federal taxes if you make under $12,500.

Once your child turns 18 years old …

They will open a Roth IRA. Then you should be able to transfer the account from the custodial Roth IRA to the regular Roth IRA. If you do this through Fidelity (my recommendation), you can call their customer service if you need help.

Please know that only a few brokerages offer a custodial Roth IRA. A brokerage is where you open an investment account. Examples include Robinhood, Fidelity, Vanguard, TD Ameritrade, etc. Fidelity is my favorite, although I have never tried Vanguard.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!