This is one stock trading mantra but what does it really mean and is it important?

Letś start with the second question: is it important?

Answer: For most investors, no and here is why:

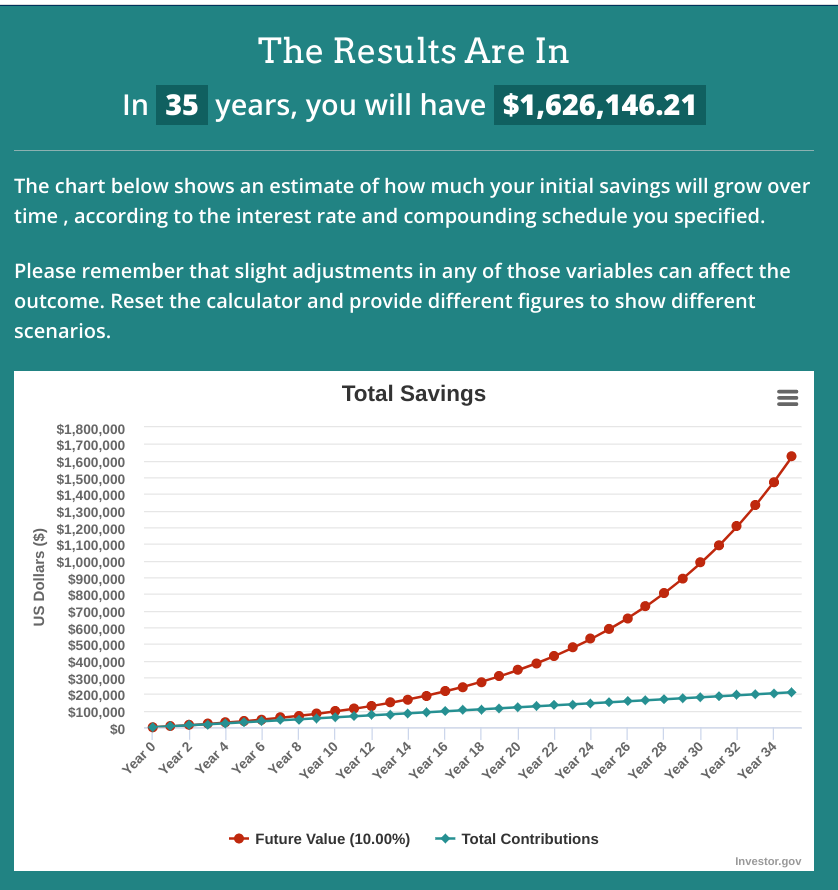

In order to build wealth and financial freedom, investing and time are your most valuable assets. Compound interest creates a hockey stick effect that experiences exponential growth during later years. So you need to invest as much as you can, as often as you can and leave that money for decades, ideally 30+ years.

This graph is the compound interest calculation for investing $500 a month for 35 years with 10% rate of return which is the historical average for the S&P500. Notice that between 20-35 years is when you money really starts growing exponentially with almost zero effort on your part. So the mantra for wealth builders is

BUY AND HOLD.

Buying low and selling high means you buy when the Stock Market is dropping and sell when it is up. This sounds reasonable but is very hard for the average investor to execute for multiple reasons.

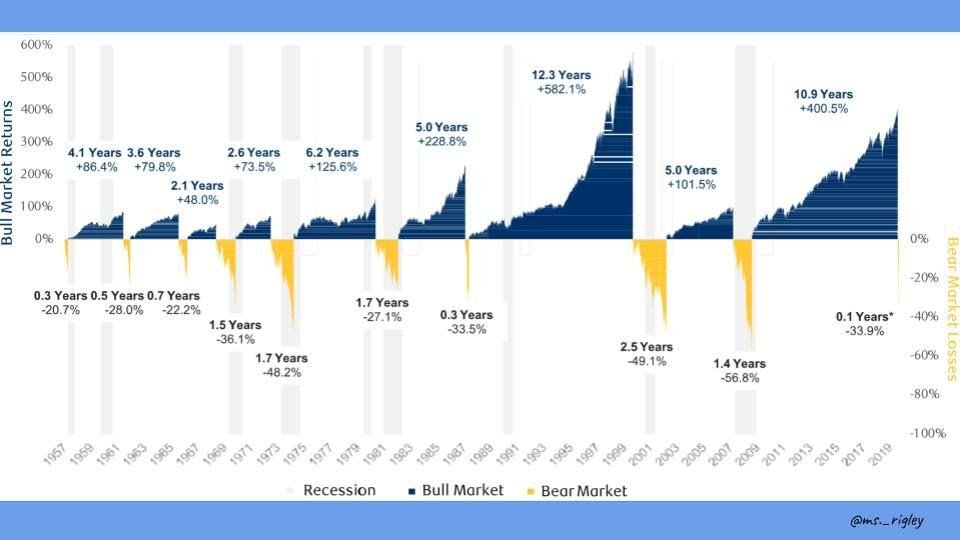

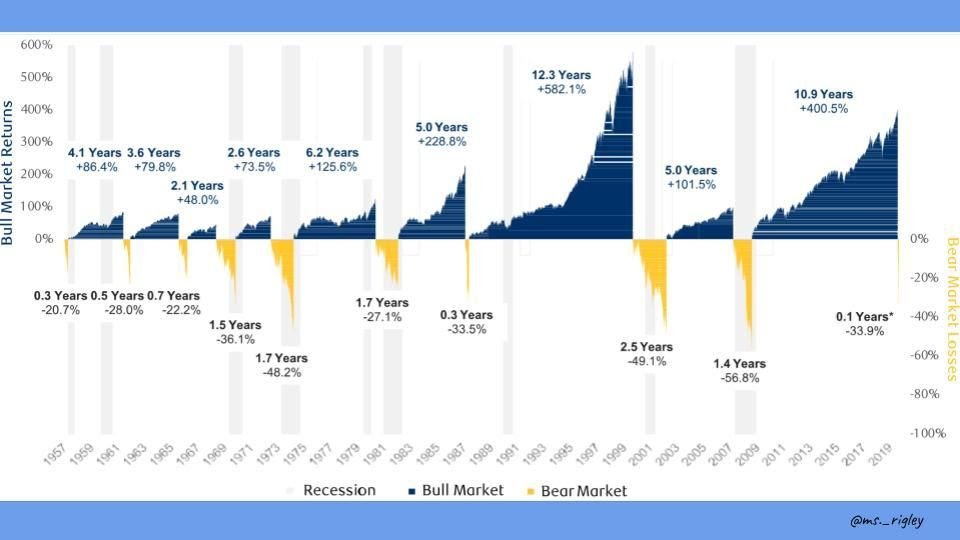

#1: The Stock Market is up way more than it is down. Look at the graph below documenting Bull (up markets) vs Bear (down markets) for the S&P500. You could be waiting years before a significant correction happens and that correction may or may not bring prices back to your original purchase level.

#2: You are assuming you can time and accurately read the bottom and top. I assure you, this is virtually impossible, especially over a 30 year investing period. Just in the past few months, the S&P 500 has been down $10 per share in the morning only to close up $8+ per share! These kind of roller coaster rides are common and completely unpredictable. When is the high? When is the low. Hindsight is always 20/20 but impossible in the moment.

#3: Buying low means you are buying when the world and economy is uncertain and terrifying. Buying low means there is devastation in peoples’ lives and the economy. Examples: the dot.com burst, the Great Recession (2008-09), i.e. the housing market collapse, COVID & lock down in March 2020, Russiaś invasion of Ukraine. All of these events are terrifying in the moment and last anywhere from a few months to a few years. Buying low sounds good but people forget to mention the chaos that comes with the moments that cause the Stock Market drop to happen. Buying low means you throwing money into the Stock Market when it seems like the world is ending. Do you have nerves of steel?

#4: Buying low assumes the economic devastation that is causing the Stock Market crash has not effected your economic stability. You assume that you wońt lose your job or need to dip into emergency savings. I hope this is true but sadly not always the case.

The Takeaways

If you buy monthly, or on a regular interval, you are doing something called dollar cost averaging. If I am able to purchase $200/month, when the Stock Market is high, my $200 will buy less shares. When the Stock Market is low, my $200 will buy more shares. This strategy helps remove the emotion from investing.

Finally, when the world is ending and the Stock Market is dropping, know that wealth building has gone on sale. Stick to your plan, keep investing, dońt watch your account value (which will recover) and NEVER SELL (unless you need the money in retirement).

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!