You need a yearly emergency fund

Wait: Do you have 3-6 months of living expenses in the bank? If you are still working on this financial objective then stay focused and come back to this once you have achieved that amazing milestone. You got this.

I budget every single penny. This means there is no room for unexpected expenses. I save for Christmas, a small amount of splurges, vacation, car maintenance, etc. I try to plan for it all but as we all know, life is full of the unexpected and most of the time unexpected events cost money.

A few years ago, I noticed that things were going financially wrong or at least unplanned to the tune of $6,000 per year. Yikes! My husband and I have an emergency fund but if I take money from there then I have to replenish the account which is not part of my monthly budget. So I decided to create a savings account for yearly unexpected expenses. In 2020 I came back to teaching full time and got a nice pay increase which allowed me to allocate $500 per month to a yearly emergency fund.

This savings account (called Expect the Unexpected) has been a financial lifesaver. This year I have needed this account for the following unexpected expenses:

- Dryer repair ($300!)

- Pilot light going out on water heater

- Earthquake insurance increasing $500 with zero warning

- Having to pay Bailey´s new preschool on the 20th of the month and we don´t get paid until the last day of the month

- Having to pay double preschool bills as Bailey´s transition occurred mid month.

- A $350 supply fee for Bailey´s new school

- Forgetting my orthotics on vacation – a painful financial mistake

Having this savings account has given me so much relief and has significantly lowered my financial stress. Think about creating your own yearly emergency fund. This way yearly unexpected expenses are part of your monthly budget and you don´t have to put in the work of replenishing your emergency fund.

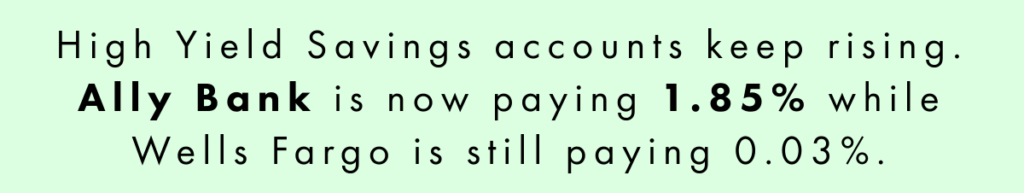

As of 8/29/22

Budgeting is everything and the key to your financial puzzle. If you need extra help, please consider these two options: 1) working with me to build you a budget or using my budget template and video instructions.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!