How do you talk about money with your kid(s)?

Does your kid(s) get an allowance?

When do you say, ¨Yes¨ and when do you say ¨No¨ to request to buy something at the store?

Bailey just turned 4 at the end of the summer and these questions have been plaguing me, especially as a personal finance guru. Many people do the savings jars but I struggled with this because most of our money transactions are digital. Yes, it would be easier for her to grasp the concept of money if she can physically see and touch it but that is not how she sees me spend money. Plus she occasionally buys things on Amazon so then she would have to hand me her money then I would purchase with my card. I want her to learn how money works, not the baby version. If she is buying something online, I want her to do it, not me doing it for her. So here is where I landed:

- Bailey gets spending money every month. I give her $35 a month, $5 which she saves to donate to wildlife rescue at the San Diego Zoo. We discussed the importance of giving and went through a bunch of different charity options with her; she picked the San Diego Zoo. At the end of the year, she will use her debit card to make her donation (more on this below).

- $35 was a completely arbitrary number. I wanted her to have some money to donate and still have enough money to have one splurge a month. Some people give money based on age but $4 a month or week didn´t seem like enough. So $30 a month is where I landed, not too much and not too little.

- The nice thing about her monthly spending money is it allows her to make one and only one purchase a month. It forces her to make a decision for the month as her money will only cover one purchase. This allowance also changes the narrative of our money conversations. Instead of Scott or I constantly having to say ¨yes¨ or ¨no¨ about requests to make a purchase, we put the decision back on her.

- We use a physical calendar to review the days of the week and cross them off as we go. The 1st of the month has a $ to signify when she gets her spending money as it is the day after Scott and I get paid.

- Her spending money is not tied to chores. I believe it is everyone’s responsibility to take care of household chores and you do not get paid for doing your part. If Bailey is not being her best self and doing what we ask, then she loses out on her 1 TV show in the afternoon, not her splurge money as the two are not connected in our house.

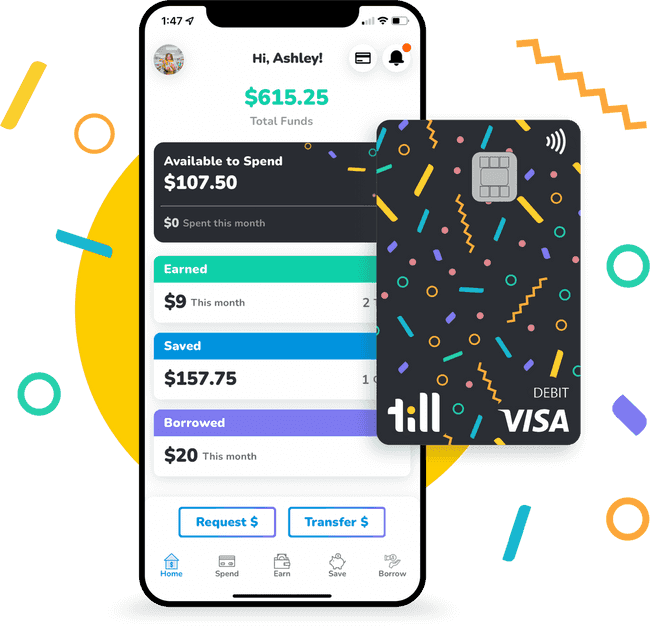

I did a bunch of research on debit cards and bank accounts for kids and this is where I landed. There are limited options for kids under 13. I like Till because it gives her a debit card in her name and is free. There is an app that allows me to transfer money to her, view her balances and create savings accounts attached to goals. At the first of the month, we make the transfer and send money to her savings for charity. Since this is a debit card, she can make purchases online and in stores. She has a wallet that holds her debit card and stays in my purse.

The main drawback, I cannot connect her debit card to her investment account. Originally I was going to give her $40 a month which included $5 for her custodial Roth IRA. However, Fidelity will not let me connect to a debit card, only a bank account. For now, her and I transfer $10 a month from my bank account to her custodial Roth IRA and make the investment. In my next newsletter, I will cover custodial Roth IRAs.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Past performance does not guarantee future performance. Always remember to make smart decisions and do your own research!