#1: Do your research.

What do you want or need in a new car? Gas prices are high and will probably remain high so you may want to consider fuel efficient options. Make sure you visit a dealership and test drive the car as part of your research.

#2: What is the MSRP for the car?

Due to all the supply chain issues from COVID, most dealerships are selling cars for more than MSRP. You want to search around and find a dealership that will see at MSRP (the sticker price). Gone are the days when you can negotiate a price below sticker price. If you are ordering a car online, your final price is often more than MSRP after to add any bells and whistles that you want.

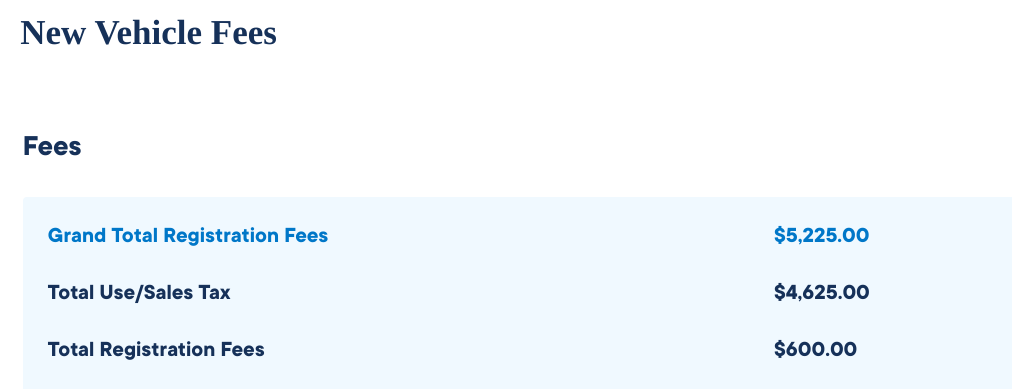

#3: How much are the taxes and registration?

The cost of buying a car is not just the sticker price but also the taxes and registration. In CA, the DMV has a calculator to help you estimate how much you will owe for taxes and registration at the time of purchase. Link for CA DMV here. If I bought a car that is $50,000, I would owe an additional $5,225 making the total amount of my purchase $55,225.

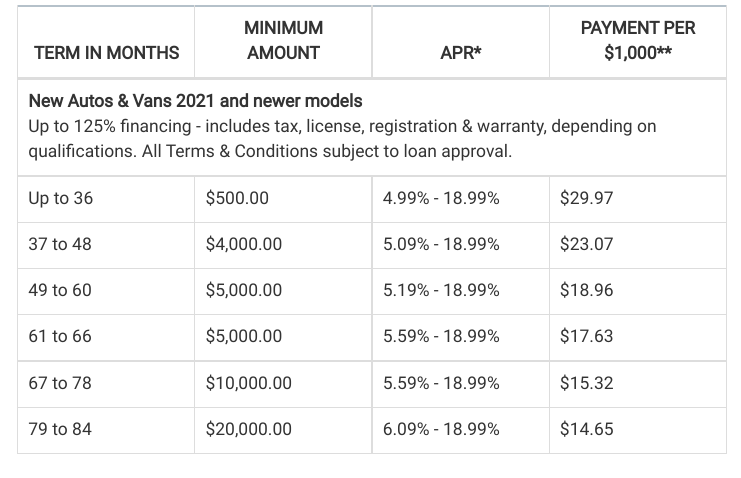

#4: Start shopping loans

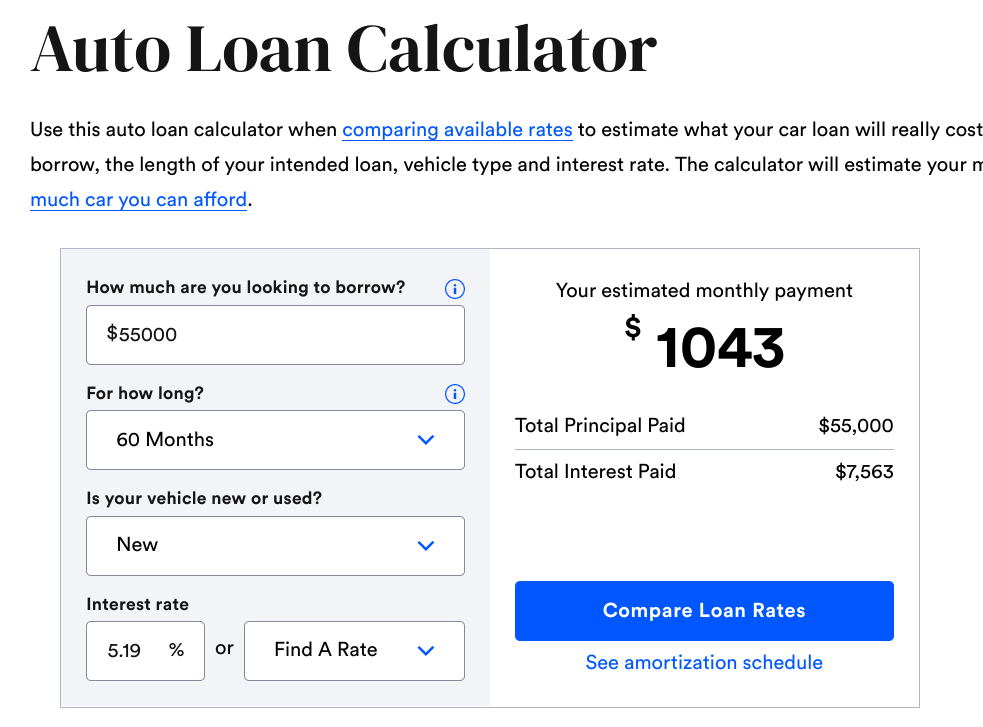

Credit unions can offer the best interest rates. You can get financing at the dealership but with high interest rates, it benefits you to shop your prices. Please keep in mind that as long as inflation is high (above 2%), the Federal Reserve is going to keep raising interest rates when they meet every other month. The longer you wait to buy the car, the more expensive it will be due to higher interest rates. This doesn´t mean rush out and buy a car you cannot afford but if you need to buy a car, sooner will be cheaper. When I pulled the interest rates from Travis Credit Union last month, the interest rate was 3.99% for a 60 month loan and now it is 5.19%. This is an additional $30 a month or $360 per year (estimates are based on the car loan calculator used below).

#5: Calculate your monthly payment

You can use a car loan calculator, link here or a chart provided by the loan provider you are considering. Make sure you include the cost of the taxes and registration in your loan cost. If I use the chart above for a 60 months loan, it is $18.96 x 55 (for $55,000) = $1,042.80 per month which is exactly what I get by using the auto loan calculator below. Usually you need an excellent credit score to qualify for the best interest rates. If this is not the case for you, then you need to use a higher interest rate for your estimates.

In these calculations, I assume zero dollars down so I can get a feel for the maximum monthly cost. If you are buying a new car and putting $10,000 down then put $45,000 for cost to borrow instead of $55,000.

#6: Remember this is an estimate

You will not know your official monthly payment until you submit a loan application and get approved by a lender.

#7: Don´t forget to consider your car insurance

New car insurance is more expensive than a used car. Make sure you talk to your insurer to get a car insurance estimate to ensure you can afford the higher monthly payments.

#8: Other notes

Some cars take months to manufacture. If you place an order online, it could be 4 months to a year before your car is ready. There is no way to lock in your auto loan interest rate so any estimation you do now will probably be higher when the car arrives so plan accordingly.

Some cars qualify for Federal and State tax credits. These are usually clean air vehicles or electric vehicles. Do your research because this could be $7.500 or more.

Yikes! This is the example I have been running for months. My awesome CRV is 14.5 years old and runs like a champ but may need to be replaced in the near future as it has 200,000 miles. Every time I run these numbers, I hug my CRV and we keep on trucking. I did place an order for a new car but if it doesn´t come in by the end of the year, when I get the tax credit, I will probably wait until my daughter is done with preschool ($1,850 a month) to take on a car payment. For the meantime, the CRV runs great and I would rather keep putting money in my vacation fund, yearly emergency savings and investing for retirement.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this newsletter.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!