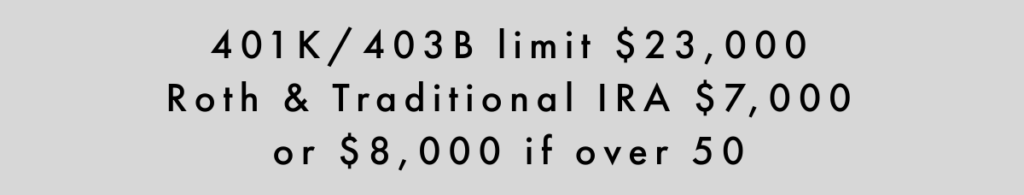

2024 Retirement Contributions Limits

Money Considerations for 2024

Prices are still high and will remain high. In the past 3 years we have experienced an almost 17% increase in prices. Although inflation has leveled off in the past few months to 3% increase per year, the higher prices are still hitting hard. The only thing that brings prices down is a recession. In 2009, deflation was -0.4% so even a recession won´t relieve our 17% price hike. Essentially we are stuck with these prices and need to adjust, if you haven´t already.

In 2023, I did not adjust my budget for rising prices but this year I have to. The last 4+ months, I have been consistently over budget with my food spending by a few hundred dollars a month. Luckily I was making more money last semester because I was teaching over full time but that will not be the case in 2024. Going forward if we overspend on food (likely) then I will take that money from our monthly vacation savings of $500 a month. This breaks my heart as vacationing is how I live my dream life but I don´t want to pull my daughter out of her activities, reduce my retirement contributions or take on credit card debt so this was the only other option. Next school year my daughter transitions from full time care to after school care which should give us some financial relief especially since neither my husband or I are getting a raise this year.

Interest rates on savings are great but could start declining. In December the Federal Reserve announced 3 potential rate cuts in 2024. When the Federal Reserve lowers interest rates, the interest in our high yield savings account also drops. One way to secure a higher interest rate for longer is to buy a CD. Ally Bank is offering 12 month CDs for 5.25% to 5 year at 4.10% and anything in between. Money in a CD should be for long term savings as this money is relatively inaccessible until the maturity date. New IBonds are paying 5.27% with 1.30% fixed rate. Even though interest in high yield savings accounts could drop 0.75% in 2024, they far exceed the interest rates being offered at the big banks (i.e. Wells Fargo, Chase & Bank of America paying 0.03% or less).

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this blog post.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!