Ms. Rigley, what do you think about borrowing $350,000 for college?

One of my students recently asked me this question as he got into his dream school of Northwestern which costs $90,000 per year with housing. He is in my personal finance class so he already knows a lot about managing his money but let’s dive into what is the reasonable amount to borrow for an undergraduate degree.

#1: Loans

Students who are dependent on their parents for support and under 24 years old can only borrow $5,500 per year in their name. This means that a parent or guardian would have to borrow the remaining money (assuming you don’t have this stock piled in your sock drawer or savings account).

#2: Parental Support

Are your parents able and willing to borrow $84,500 per year for your college degree? The best route is to apply for FAFSA which is due April 2, 2024 to see if you can even get this amount of money in a Plus Loan. By filing for FAFSA you also have the chance of getting grants and scholarships which would lower the overall cost of attendance each year. Please remember that you have file for FAFSA each and every year you plan to go to school.

#3: Repayment

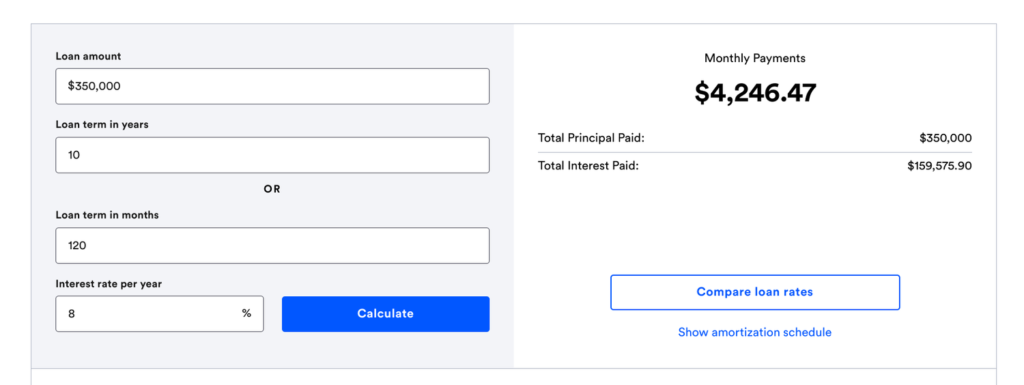

My student said he would repay his parents upon graduation. How much would your monthly payment be to repay $350,000 in student loans? For these calculations, I am going to assume 8% interest which was the interest rate for the 2023-24 school year for plus loans.

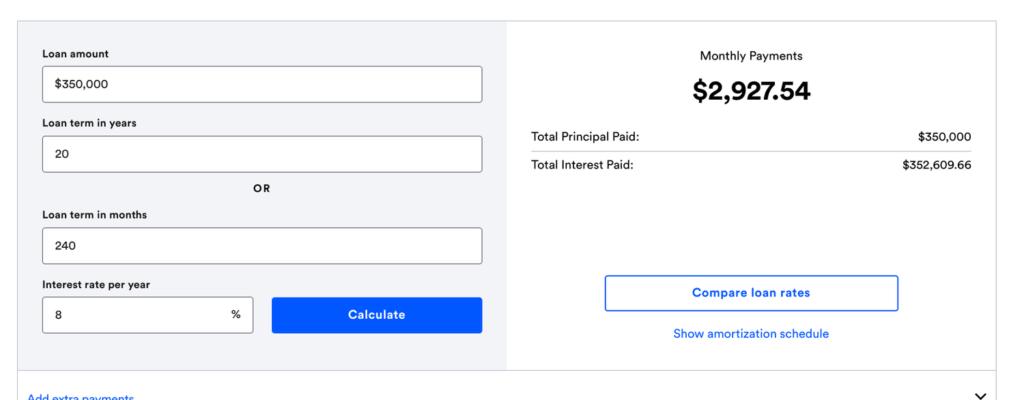

The standard repayment loan term is 10 years. There are other repayment plans that limits your payments to 10-20% of your pay and pushes the repayment term to 20 years. For most people taking these repayment options, their loans balloon over those years because their monthly payment is not enough to even cover the interest on your monthly payment. There has been reform in student loans that would allow your loan to be forgiven after 20 years of repayment. Here is the monthly payment for a 20 year plan which does not include the income cap.

If the starting salary out of college is $55,000 then your monthly take home pay is roughly $3,208. Your income based repayment is based on your gross pay, not take home. This means at 20% your monthly payment would be $916 and at 10% (if you qualify for this plan), it would be $458 per month. Also remember that in this example, the majority of the loans are held by the parents. Therefore the income calculations will be based on their income, not yours.

#4: What does it mean for my future?

Most young people have zero idea what these numbers mean and what a payment of $458 – $4,200 a month would mean for their living standard. I implore all parents and young people to engage in the following money activities I do with my personal finance students:

This is a series of 5 activities for teens to start planning their dream life and seeing how much it costs.

- They will research housing and learn about take home pay.

- They will calculate the payment of their dream car, mid level car and budget car.

- They will do a meal plan and see how much it would cost to feed themselves if making all of their meals vs eating out.

- Then they will pull all of these numbers together to get the cost of their dream life and take time to reflect on their number.

- For the final step, your teen will take everything they have done and learned and create a starting budget out of college with a $55,000 salary, which is usually significantly less than their dream budget. In this budget they have a specific amount they have to save and invest and have to include their potential student loan payments. This gives young people a good dose of reality to what their life could look like post college and therefore better able to comprehend the cost of their college degree and whether or not it makes financial sense for them.

#5: How much should I borrow for undergrad?

Here are the recommendations:

- The total amount borrowed should not be more than 80% of your first year salary out of college. I know most young people have no idea what they want to do for a career. Yet, before taking on a huge sum of student loan debt, they need to put in some work to figure it out, knowing that this plan can change at any time during their journey. You do not want to take on $100,000 in student loan debt to become a social worker that might make $40,000 per year. This mathematically does not make sense. For help figuring out the best career path, please see my blog post. Keep in mind that community college can be a great place to take classes for cheaper while also exploring career options.

- $10,000 per year is the recommendation of the College and Career Counselor at my school. She believes most people will go on to get a masters degree and therefore you want to keep the amount of your undergrad degree as low as possible.

- Lastly, there is a student loan forgiveness program that will forgive your student loans after 10 years of making the minimum payment for anyone working in a government job. For years the program was misleading because very few people actually got their loans forgiven. This has changed in recent years but I would still be wary of relying on the government to free you from your student loan debt because the rules and funding can change at any moment.

Final consideration

I know most young people believe that their college degree will be their ticket to success. However, the ability to start investing between 22-25 years old will really make or break their financial success, not necessarily the name on their degree. If taking on student loan debt will prevent you from investing, then you should reconsider the amount you are borrowing.

Personal Finance is very personal. Meaning, what is right for one person may not be right for another. So therefore I did not give this student an answer but helped him calculate the monthly repayment amount, talked to him about what his take home pay could be out of college and if that repayment amount was realistic for him and what type of life that would give him post graduation. It is ultimately up to him to take everything he knows and decide what is best for him.

Ready to ignite your dreams & up level your money game?

Time to take my class and condense 15+ years of learning and trial and error into 5 weeks or less. Time to warp speed your success and life.

Financially Empowered: easy 4 money moves to ignite your dreams

Affordable option ($25/mo) BUY HERE

Class plus 4 private coaching sessions ($75/mo) BUY HERE

Individual money move units (Budgeting, Savings, Credit & Debt, Investing)

Make Your Dreams a Reality BUY HERE

Visit my website to learn more about all classes.

Disclaimer: I am an educator, not your personal financial advisor. Please make sure to do your own research before moving forward with any actions discussed in this blog post.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!